Bookkeeping for Bloggers: How to Start?

Life as a blogger conjures up pictures of a glamorous lifestyle, working from a laptop anywhere in the world – but being a professional blogger is a form of self-employment like any other.

So bloggers need to carry out the same mundane business admin tasks as any other self- employed person, including looking after their books and managing their accounting for the business.

Keeping track of all your daily expenses and income is a basic aspect of bookkeeping which all bloggers need to master – unless you choose to pay a bookkeeper to do it for you of course.

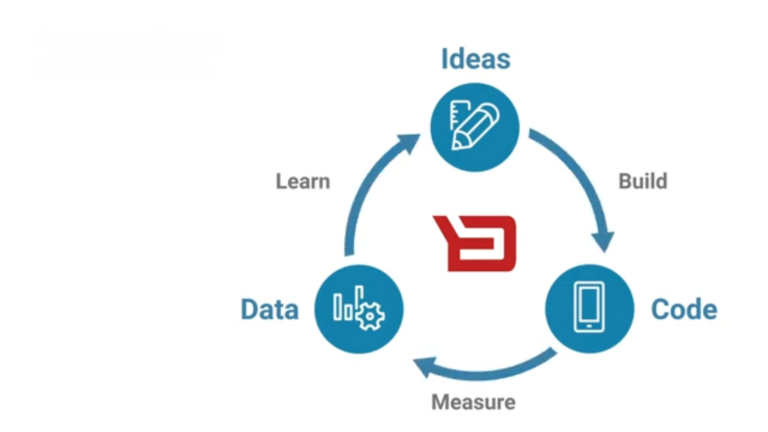

The good news is that you don’t need to become a professional accountant yourself in order to manager your blogging bookkeeping requirements. Because of their experience in this field, we asked the team behind Crunch to give us some tips and tricks on how to start getting your books in order:

1. Make sure you have a separate business account

As a self-employed blogger you need to make sure you keep all of your business income and expenses separate from your personal monies – it makes life much easier when it comes to claiming expenses and filling out tax returns.

Set up a separate business account for all of your blog-related financial transactions – it will also show anyone who is invoicing you that you are a professional who takes their role seriously.

Having a business account can also make it easier if you need to apply for business finance or to prove that you run a business for legal reasons.

2. Keep records of your income and outgoings

You need to accurately record your income and all your expenses somehow, including keeping copies of all your receipts. It’s not ideal to put them all in a shoe box under the stairs so set up a system to accurately record everything regularly.

There are software programmes set up just for this purpose to help new and small businesses, where you can snap images of your receipts and store them on your phone or laptop.

But if accounting software is too much for you then try creating a simple spreadsheet to record your income and expenses. Expenses can include things like professional fees, photography, printing, accountancy fees, travel etc… so make sure you record every item which you spend money on.

Don’t forget things like marketing and advertising, including Facebook ads, and costs for sending out marketing emails or leaflets. All of these aspects need to be recorded as expenses in your records.

Any meals for hospitality for your blog and travel incurred perhaps to interview a guest should also all be recorded down so that you know exactly where all your money is being spent and can prove it.

Even if you are working from home you should also include supplies such as printing paper and anything else you legitimately need to run your business on a daily basis. Don’t forget some of the obscure things you might not think about day to day like the cost for hosting your website.

3. Keep all your receipts

Rushing around during the day, grabbing a coffee with someone you are about to interview, and then filling the car up with petrol, it can be a hectic life but it’s important to keep all of the receipts for your expenses as well as recording them.

You need to get into the habit of storing all your receipts and matching them against the expenses on your spreadsheet. They can be stored electronically, rather than as paper but make sure you keep them.

It’s easier to record them as you go, rather than storing them all up and promising yourself a dedicated bookkeeping day as you know that will most likely keep getting side-lined and before you know it you will have a year’s worth of expenses to go through.

4. Keep track of your blogging income

As a blogger your income pattern will be very different to that of a wage earner and of most other self-employed people in that you will have things like sponsorship money, affiliate money, free gifts and incentives.

It’s important to keep track of all of these – including things like free products – so that you know exactly what you have received into your business at any time. You can create a separate section on your spreadsheet for products received, to make it easier to track.

You might also have money coming in from advertisers and from people who pay to appear on your blog. All of these income streams need to be recorded in your bookkeeping.

5. Don’t forget the taxes

As a self-employed person you are responsible for filing your own tax returns and paying your own taxes so it’s important that you make provision throughout the year, so that you can pay your tax bill when it comes around at the end of the year.

The last thing you want is to get to the end of the financial year and be faced with a huge tax bill and no resources with which to pay it. There are options for budget schemes to pay your taxes so make sure you plan ahead and have enough to cover the bill.

Many of the accounting software programmes you could use to do your books actually work out the tax for you as you go through the year so that way you will have an idea of the size of the bill you might be facing.

Summary

While bookkeeping is the least sexy part of running a business as a blogger, it’s one of the most important ones as if you don’t keep records your blogging career could be over before it begins. Bookkeeping is simply keeping accurate records of the money going into and out of your business account every single month and being able to account for every single penny with receipts and records. The key is to stay on top of it, stay organised and if all else fails you can always employ a professional bookkeeper to do it for you.